City Studying Effectiveness of Centers and Corridors Growth Strategy

Tyler Kimbrell, Planner II, 509.625.6500

Monday, November 20, 2023 at 3:59 p.m.

Planning Services has begun studying the effectiveness of the Centers and Corridors Growth Strategy to develop recommendations for modifications as we enter a Periodic Update phase for the Comprehensive Plan.

To assist in this analysis the City hired Leland Consulting Group to help us understand the market realities of development in the 23 designated Centers and Corridors. The presentation given to Plan Commission on Nov. 8, 2023, by Leland Consulting Group is available on the project webpage. Planning is still working on the full market analysis, which will be released in the coming weeks and available on the project webpage. However, a brief look into a few of the key findings from the market analysis is possible now. The deadline for the Spokane Periodic Update is in 2026.

Development in the past 20 years

Looking back to 2001, when the Comprehensive Plan that included the Center and Corridor Growth Strategy was first adopted, the city has seen 29.48 million square feet of commercial and multi-family development. About 14 percent of this development has occurred in Centers, while Centers occupy approximately 4.6 percent of the city’s land.

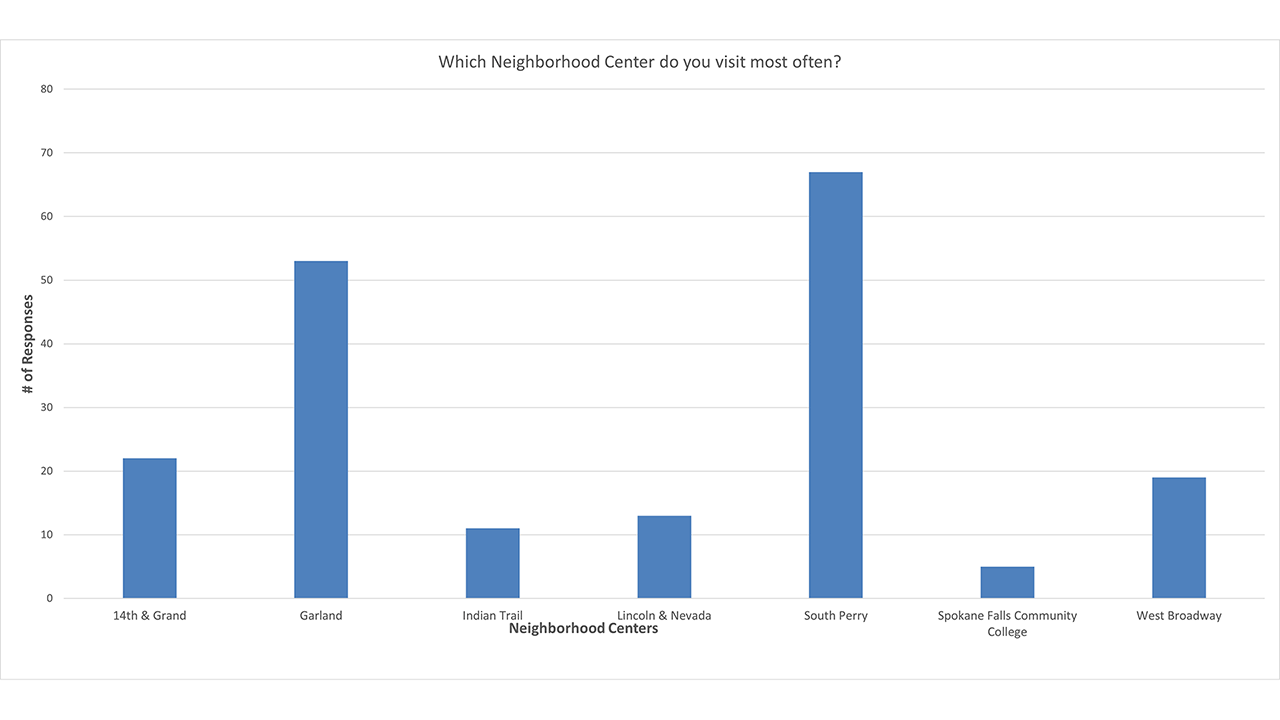

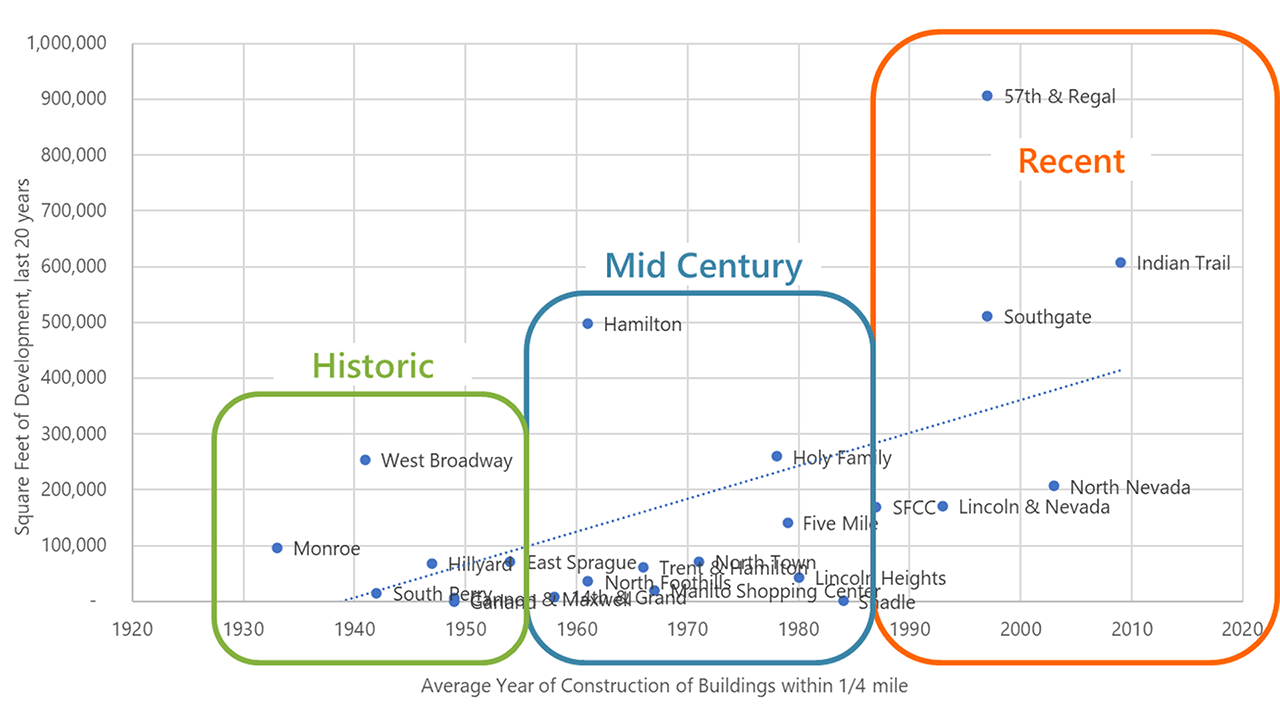

A significant portion of this development has occurred in Centers that are farther away from downtown Spokane where average year of construction is between 1985 and 2020. These Centers are classified as “Recent” Centers and include places such as 57th & Regal, Southgate, North Nevada, and Indian Trail. More new development occurs in Recent Centers because land costs are typically lower and vacant land more abundant. However, this does not capture the adaptive reuse of buildings in “Historic” Centers, which typically developed between 1930-1955 and include places such as Monroe, Hillyard, Garland, South Perry, and West Broadway. Historic Centers have seen adaptive reuse of commercial properties. When discussing Centers during community engagement, these Historic Centers are deemed some of the most beloved Centers to the community.

Figure 1. Centers and Corridors Survey Responses: which Neighborhood Center do you visit most often?

Finally, there are the “Mid-Century” Centers which refer to Centers where most of the development occurred from 1955-1985. None of these Centers, apart from Hamilton, have seen a significant increase in new development in the past 20 years. Likely, this is because the buildings are still relatively new and land costs are still relatively expensive. This makes adaptive reuse of commercial buildings or new development less feasible in Spokane’s market.

Figure 2. Development era and Square Feet of Development, 2021-2023, Leland Consulting Group

Construction market in Centers

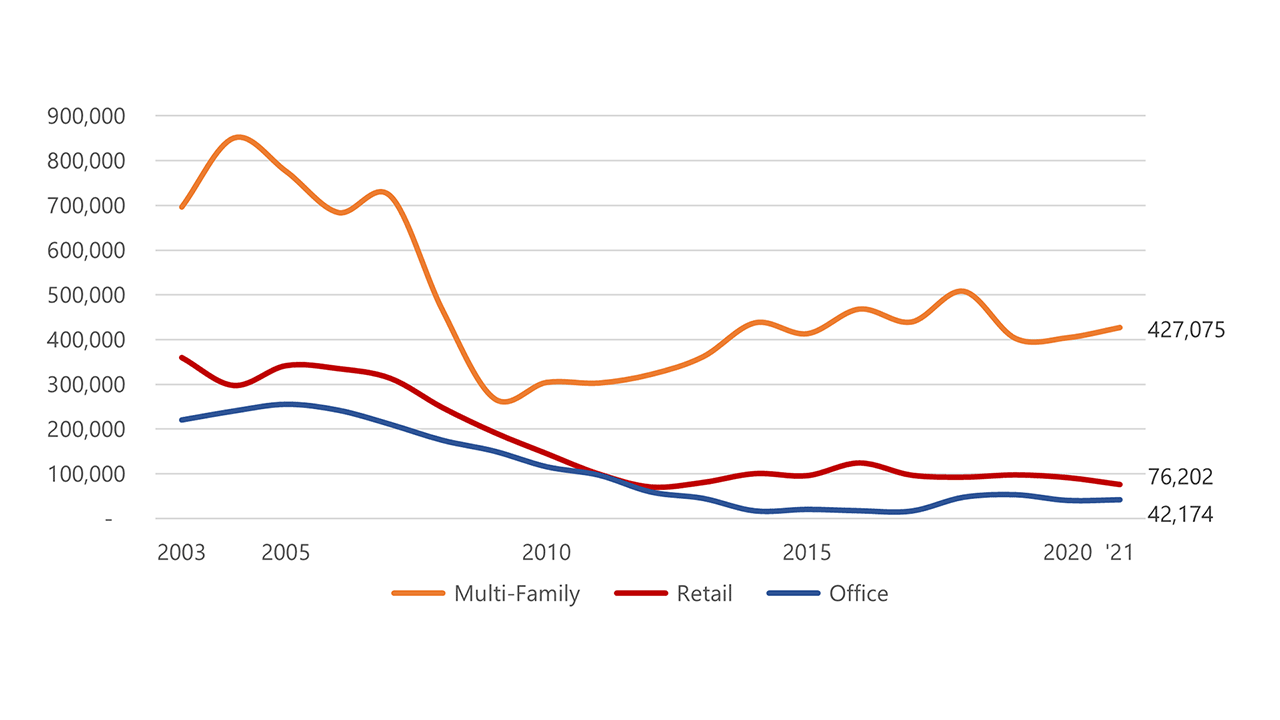

Centers and Corridors were envisioned to include a variety of uses (residential, commercial, office) to encourage a mix of activities in a single area for convenience, recreation, and living. Multi-family housing has been the dominant development type in Centers since the early 2000s, and after experiencing a sharp downturn that coincides with the onset of the Great Recession in 2007-2008, multi-family development has gradually increased. The five-year average for multi-family space in 2021 (i.e., between 2019 and 2023) was over 427,000 square feet of rentable building area per year, or 568 units per year. By contrast, the amount of retail and office space constructed in Centers has been on a consistent downward trend since the early 2000s. As of 2021, about 76,000 square feet of retail and 42,000 square feet of office space have been built annually in Centers, and most of this development has taken place in a few Centers farthest from downtown Spokane.

For the foreseeable future, Leland Consulting Group expects the dominance of multi-family development to continue. Conversely, new, ground-up construction of retail and office space will continue to slow, consistent with trends across the nation.

Figure 3. Building area in Centers by development type, five year rolling average, 2003 to 2021, Leland Consulting Group

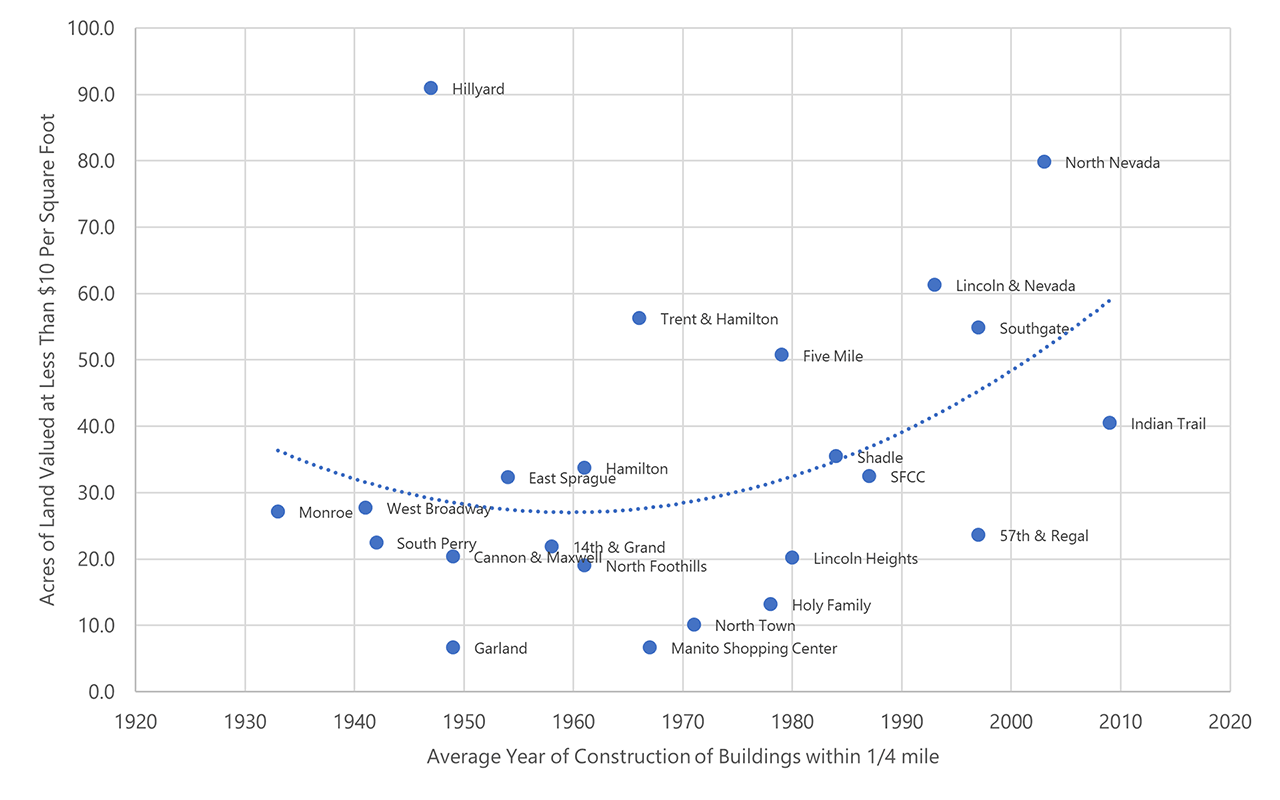

The supply and cost of land is more of a determinant as to whether Centers are more likely to develop as opposed to the amount of demand for development in those areas, despite the community’s general desire to see more walkable, pedestrian friendly environments. This is exemplified in the amount of development occurring in Recent Centers as opposed to Mid-Century or Historic Centers where land available is typically lower and land cost higher.

The graph below shows that low-cost land is still available in Recent Centers. For example, there are more than 60 acres of land valued at less than $20 per square foot at Lincoln & Nevada, and about 80 acres at North Nevada where there is currently a 504-unit project under construction. This represents a significant supply of lower-cost land, which can be built out in coming years or even decades.

Figure 4. Average year of construction and acres of land valued at less than $20 per square foot, Leland Consulting Group

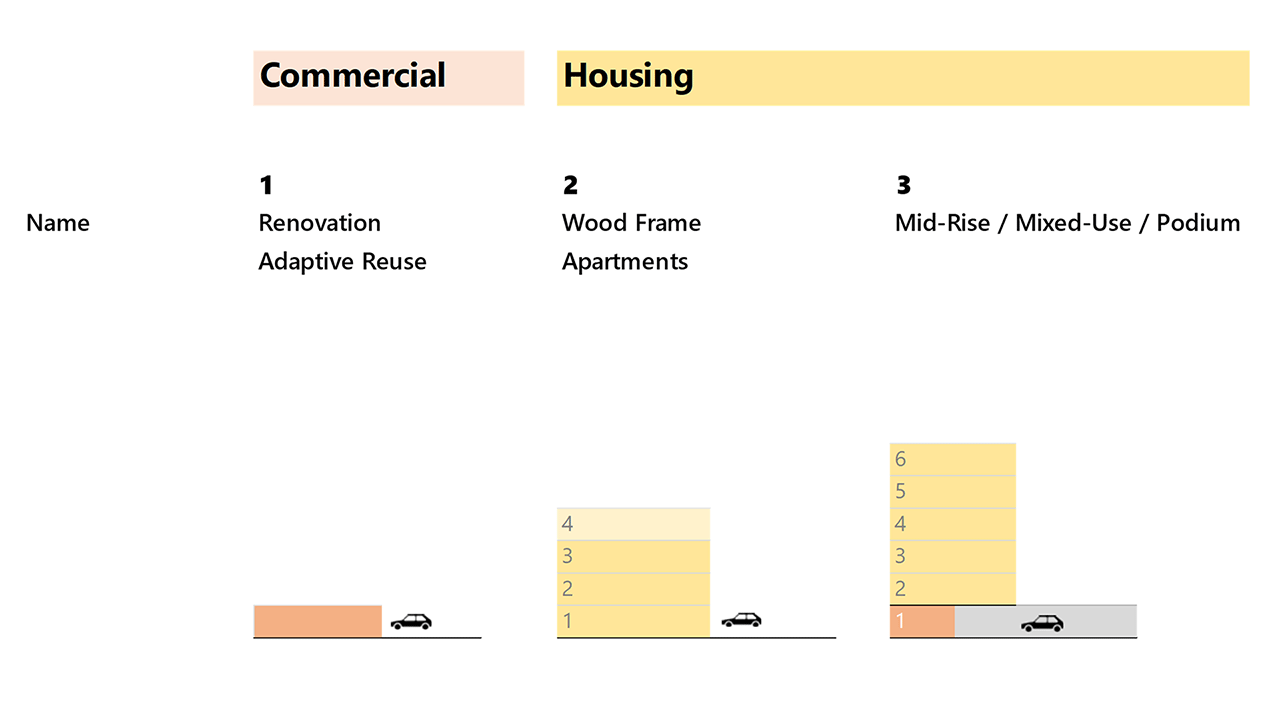

Because of higher land costs in Centers, Leland Consulting Group suggests that Spokane is more likely to see up to four-story wood frame apartment buildings over the next 10 to 20 years. This development type reflects a lower per unit cost to the developer, ensuring that the rents can cover costs of the land and the construction of the building.

For commercial development, it is more likely that Spokane will see adaptive reuse of commercial buildings due to reduced demand for retail and office space paired with high land costs. Finally, mid-rise/mixed-use/podium projects are more feasible in the downtown area where rents are higher. These projects are unlikely to occur in the near term in other Centers. The figure below shows examples of these development types.

Figure 5. Most likely building typologies for Spokane Centers, 2023 to 2043, Leland Consulting Group

Final thoughts

In general, Historic and Mid-Century Centers have seen relatively low amounts of development over the past two decades, in part because there has been and continues to be a limited supply of low-cost land in these Centers. Recent Centers have seen significant amounts of development, in large part because they have been built out on vacant, low-cost land. Going forward, Leland Consulting Group recommends that policies for Historic and Mid-Century Centers should focus on attracting development and redevelopment, followed by connectivity and walkability improvements such as the streetscape improvements completed on North Monroe and East Sprague. For Recent Centers, the policy focus should be on improving connectivity between commercial and residential developments already in place.

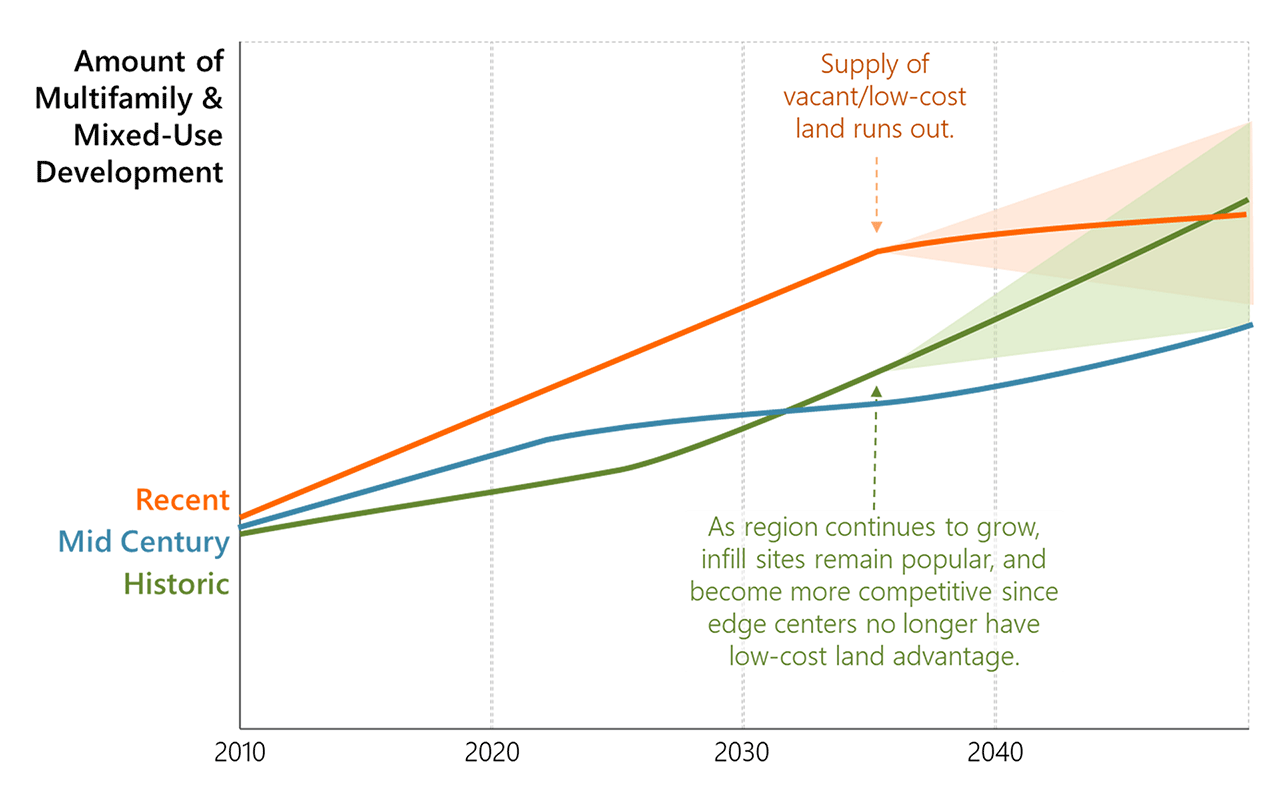

As the region continues to grow, the supply of low-cost vacant land is likely to decrease. This will lead redevelopment to occur in more Historic and Mid-Century Centers. As shown in the figure below, Historic Centers are likely to attract more development over the next 20 years. The increase could be large or modest, depending on various factors as described in the report, such as the strength of the regional and city economy, interest rates, city zoning/regulations, incentives, and other circumstances.

Figure 6. Forecast for Historic, Mid-Century, and Recent Centers, Leland Consulting Group

Stay in touch!

This blog post was a snippet of the analysis performed by Leland Consulting Group. To stay informed and to review the full report, visit our Centers and Corridors Update Study Project Webpage. Planning Services will be posting all documents as they become available. Don’t forget to sign up to receive email notifications when new content is posted!

More About...

- Analysis

- Centers

- Comprehensive Plan

- Corridors

- Economics

- Garland Avenue

- Growth

- Housing

- Lincoln Heights

- Market

- Open House

- Perry Street

- Planning

- Policies

- Regulations

- Shadle Park

- Strategy

- Survey