Multi-Family Tax Exemption

To encourage multifamily development and provide affordable workforce housing, the City of Spokane's Multifamily Property Tax Exemption Program (MFTE) provides a unique opportunity for developers to assist in meeting the need for additional housing by providing a tax break to qualifying multifamily projects.

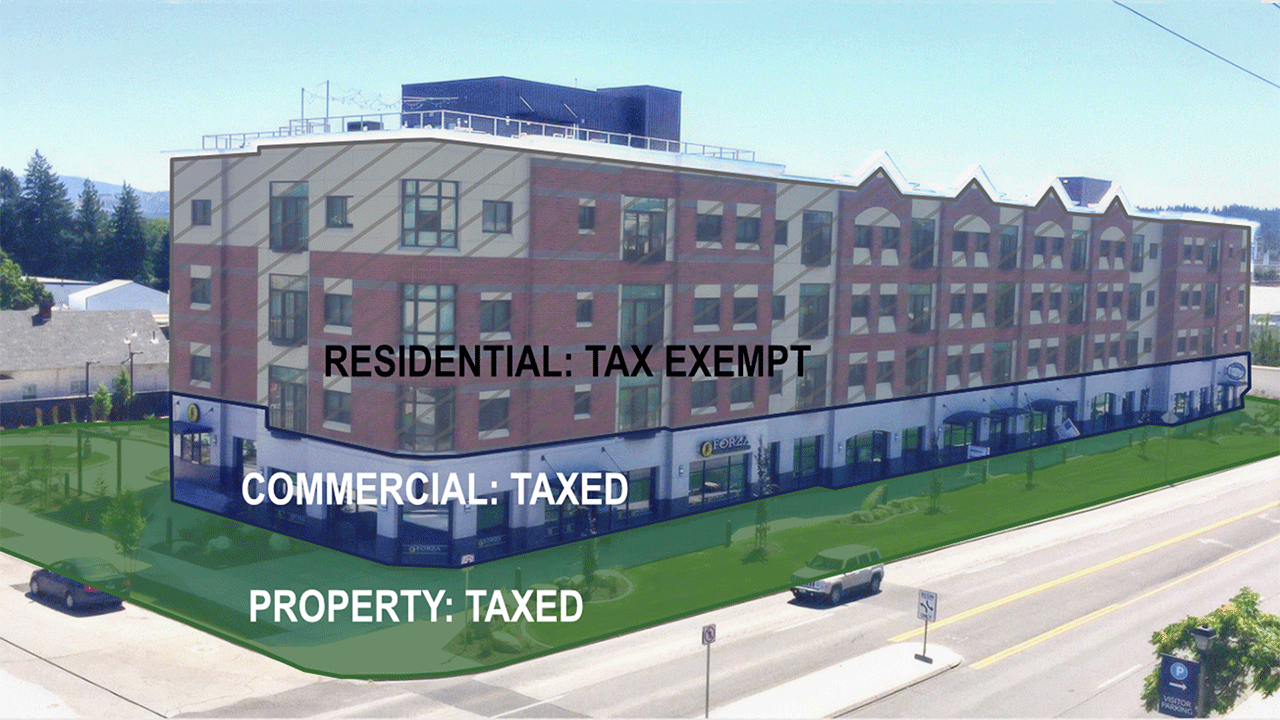

Under Chapter 84.14 RCW, local governments can give exemptions for new construction, conversion, and rehabilitation of multifamily residential improvements with at least four units. Under these exemptions, a property owner does not have to pay property taxes on the residential improvements for a given number of years. The property owner still pays tax on the land and on non-residential improvements like the commercial portion of a mixed-use building.

The City of Spokane’s MFTE program has been in existence since 2000, and regulatory updates were approved by City Council in 2022 to comply with recent updates to state code (Ordinance C36243, Resolution 2022-0068). To implement the MFTE program there are two emphasis areas, the Spokane Targeted Investment Area (STIA) and the Affordable Housing Emphasis Area (AHEA), as well as three different tax exemption term lengths – 8, 12, and 20 years. Further details on the program can be found under the dropdown menus. A complete list of regulations can be found in the Spokane Municipal Code Chapter 08.15 SMC.

Housing Units Required per Tax Exemption

There are three multifamily exemption types within the City of Spokane:

- 8-year market rate, only allowed within the Spokane Target Investment Area

- No income or rent restrictions

- Only MFTE exemption that can be utilized for student housing projects

- 12-year affordable allowed within the STIA and the Affordable Housing Emphasis Area

- For 4-11 units, 25% of the units must be income and rent restricted

- For 12 + units, 30% of the units must be income and rent restricted

- 20-year permanent owner-occupied affordable, allowed within the AHEA and the STIA

- 25% of the units will be sold to a qualified non-profit or housing authority, for sale to owners with an income no more than 80% of AMI

- Remaining 75% of units can be sold/rented at market rate

- Requires deed restrictions to ensure permanent affordability

Target Areas for Exemptions

The MFTE Program aims to avoid a concentration of workforce housing in any one part of the city, instead distributing housing attainable to a mix of incomes throughout Spokane's neighborhoods. This is done by supporting the construction of workforce housing in areas that are not designated as economically distressed while encouraging market rate housing in distressed census tracts. The distribution encourages housing choice by allowing Spokane residents to live in any of our great neighborhoods.

Spokane Targeted Investment Area (STIA) – Economically distressed census tracks

The STIA encompasses 34 economically distressed census tracts across the city. To encourage a greater mix of incomes and housing types, the City permits the 8-year, 12-year, and 20-year tax exemptions in this target area (the brown area on the map).

The STIA utilizes the federal Community Development Financial Institutions (CDFI) Fund requirements for defining a distressed community for the New Market Tax Credit (NMTC) program. These distressed census tracts:

- Have a poverty rate of at least 20%

- Are where median family income does not exceed 80% of the area median income

- Have a high unemployment rate (greater than 1.5 times the national rate)

These distressed census tracts are updated by the CDFI Fund periodically between each decennial census, and therefore will change over time.

Affordable Housing Emphasis Area (AHEA) – Not economically distressed census tracts

This area encompasses the City's remaining census tracts, which are not economically distressed. To encourage the development of workforce housing outside economically distressed area the City only permits the 12-year and 20-year tax exemptions in this target area (the orange area on the map).

Income and Rent Restrictions

“Affordable housing” is rented by a person or household whose monthly housing costs, including utilities other than telephone, do not exceed 30% of the household’s monthly income. Different price points are affordable for different income levels. For housing incentivized through this program “affordable housing” means residential housing that is within the means of low- or moderate-income households. Income restrictions are defined by State law in RCW 84.14.010.

The City of Spokane bases its Area Median Income on the HUD Income Limits Documentation System, which is updated annually. While property owners or managers do not need to calculate 30% of monthly income for each tenant in a MFTE unit, knowing where a tenant's annual/monthly income falls within the 80-115% AMI range is still information that needs to be determined.

For Developers and Property Owners

You can reach out to the Economic Development team with questions on potential sites even before you submit for a Pre-Development conference. We highly encourage interested property owners or developers to connect so that our team can see what other city or state incentives can apply to your project. The MFTE program can be layered with other incentives such as Parking 2 People, or the recent incentive approved by the Legislature through E2SSB 6175.

Tax Savings

Projects that maintain affordability throughout the exemption period can expect to save approximately $966 per $100,000 of assessed value on the exempted housing constructed. The exemption of assessed value is only applied to housing portions of the property. Property taxes will be owed for the land and any maintained improvements existing on the project site.

Tax savings will change as the levy rates for the City of Spokane change. The Spokane County Assessor offers a guide to estimate property taxes which you can read at Spokane County Assessor website. Download the MFTE Estimated Savings Calculator to help you estimate your possible property tax savings.

Residential improvements are tax exempt for the length of the MFTE exemption period, while property taxes on the land and any commercial uses are still assessed.

Application Process

1. Before Construction

A Conditional Multi-Family Tax Exemption contract must be approved before submitting for plan review or permits. Visit Accela Citizen Access and create an application by navigating to "Historic Preservation & MFTE" and selecting “Create an application.” For detailed instructions on how to fill out the online application please see the General Information guide.

Conditional Multi-Family Tax Exemptions contracts are valid for three years. If construction has not been completed, an applicant may request in writing an extension for one 24-month extension.

Applications must be approved as complete, including payment, by the 4th Monday of the month to be on the next Urban Experience agenda. For an overview of the application timeline please see the MFTE Application Timeline

2. After Construction

Once a Certificate of Occupancy or a Temporary COO has been issued, the applicant must apply for a Final Multi-Family Tax Exemption certificate. Complete and submit your MFTE Final Application (PDF 567 KB).

The City will review the application to ensure the project will maintain compliance with income and rent restrictions as outlined in the Conditional MFTE contract. The City then files the final certificate of tax exemption with the Spokane County Assessor. Beginning January 1st of the year immediately following the calendar year the Final MFTE Certificate is recorded, the tax exemption begins. For example, a final agreement recorded in 2024 will go into effect in 2025.

| Application Fees | |

|---|---|

| Conditional MFTE Contract | $1,000 per parcel |

| Final MFTE Certificate | $2,000 per parcel |

| Conditional MFTE extension | $1,000 per parcel |

Annual Reporting for Property Owners/Property Managers

Depending on the length of the project exemption, for the next 8, 12, or 20 years the property owner or property manager is required to file an Annual Report certifying that the property is in compliance with the Final MFTE certificate. Annual Reports are due to the City by February 1 each year. Use the following links to access the appropriate Annual Report forms.

- Annual Report 8yr or 20yr Exemptions form (PDF 323 KB)

- Annual Report 12yr Exemption form (PDF 432 KB)

- Property Managers with 12yr Exemptions must have tenants complete the Rental Tenant Annual Income Certification form (PDF 376 KB) for their affordable qualifying units.

Affordability Compliance

State regulations outlined in RCW 84.14.010, and city code, have specific requirements for qualifying tenant incomes and limitations on rent. Affordable housing costs, including utilities other than telephone, may not exceed 30% of a household’s monthly income.

- Qualifying tenant households have an income that is not more than 115% AMI.

- Per State requirements, housing costs under this program include utilities, and both rent and utilities may not exceed 30% of a household’s monthly income.

- The MFTE program is focused on households earning between 80% and 115% of area median income (AMI). Households earning less than 80% AMI also qualify. To calculate maximum rent and utilities for <80% AMI households, multiply their monthly income by 30%.

The City of Spokane bases its Area Median Income on the HUD Income Limits Documentation System, which is updated annually. From those base numbers, the City calculates the maximum rent by unit type, AMI, and household size. While property owners or managers do not need to calculate 30% of monthly income for each tenant in a MFTE unit, knowing where a tenant’s annual/monthly income falls within the 80-115% AMI range is still information that needs to be determined to ensure compliance with exemption requirements.

Frequently Asked Questions

Do you have questions like, why does the City utilize an assumed household size of 1.5 people? Or, what utilities average does the City use? If you're a property owner or property manager with questions on how to maintain affordability compliance, determine your maximum rent, or ensure a potential tenant qualifies, please refer to the documents in the Frequently Asked Questions. If you still have questions please reach out to the Economic Development Team.

Contact Information

Planning & Economic Development Department

Economic Development Team

509.625.6500

incentives@spokanecity.org

Related Information

- 2025-2026 Spokane Area Median Income (PDF 173 KB)

- 2025-2026 Max Rent by Unit and Income (PDF 173 KB)

- Schedule a Pre-Development Conference with DSC

- 2024-2025 Spokane Area Median Income (PDF 166 MB)

- 2024-2025 Max Rent by Household Size (PDF 166 KB)

- MFTE Estimated Savings Calculator (PDF 79 KB)

- 2023-2024 Spokane Area Median Income (PDF 165 KB)

- 2023-2024 Max Rent by Household Size (PDF 166 KB)

- MFTE Application Timeline (PDF 194 KB)

- Chapter 84.14 RCW

- Chapter 08.15 SMC

- 2023 Department of Commerce MFTE Report

- Annual Spokane County Assessor Reports

- April 8, 2024 Urban Experience Committee – Agenda | Video